Here’s how

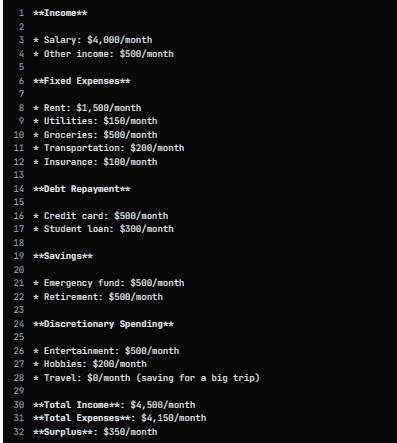

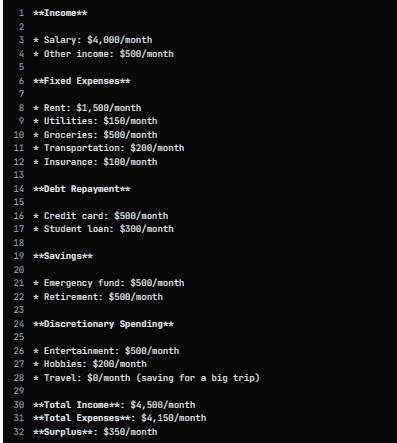

1. Identifies Income and Expenses: A budget helps you track your income and expenses, giving you a clear picture of where your money is coming from and going to.

2. Prioritizes Spending: By categorizing expenses into needs (housing, food, utilities) and wants (entertainment, hobbies), you can prioritize your spending and allocate your money accordingly.

3. Reduces Unnecessary Expenses: A budget helps you identify areas where you can cut back on unnecessary expenses, freeing up more money for savings and debt repayment.

4. Allocates Money for Savings: A budget ensures that you set aside a portion of your income for short-term and long-term savings goals, such as emergency funds, retirement, and big purchases.

5. Helps Manage Debt: By including debt repayment in your budget, you can create a plan to pay off high-interest debts and free up more money in your budget.

6. Improves Financial Discipline: Sticking to a budget requires discipline and helps you develop healthy financial habits, such as avoiding impulse purchases and staying focused on your long-term goals.

7. Enhances Financial Awareness: A budget helps you understand how your financial decisions impact your overall financial situation, making you more aware of your spending habits and more intentional with your money.

8. Reduces Financial Stress: Having a budget in place can reduce financial stress and anxiety, as you’ll feel more in control of your finances and better prepared for unexpected expenses.

9. Helps Achieve Long-term Goals: By allocating money for long-term goals, such as retirement or a down payment on a house, a budget helps you make progress towards achieving financial freedom.

10. Encourages Review and Adjustment: Regularly reviewing and adjusting your budget helps you stay on track, make adjustments as needed, and celebrate your progress towards financial freedom.